There are many DeFi-based cuisine-based projects. We have PancakeSwap, BakerySwap and SushiSwap. Today we will focus on Cake DeFi (DFI). Cake DeFi (DFI) is yet another decentralized finance platform. It has its own token. But what makes Cake DeFi different from the rest? You might be surprised.

We will take a closer look and see if there is a compelling reason for us to be involved.

What is Cake DeFi?

Cake DeFi, a Singapore-based platform for staking, lending and liquidity pools, allows users to deposit tokens and earn yield.

Cake DeFi, despite its name “DeFi”, is a custodial platform offering a range of features based on various DeFi products.

Cake DeFi has three main products: Liquidity Mining and Staking. Each product generates a different rate of return and requires different requirements. Lending digital assets such as BTC, USDC and ETH can bring in around 6.5%, while Liquidity Mining can make it up to 80%.

Cake DeFi Background

Cake DeFi was established in 2019 by Dr. Julian Hosp and U-Zyn Chua.

Top Recommended Platforms

78% of retail investor accounts lose money trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading forex or CFDs on margin involves a high degree of risk and may not be suitable for all investors. There is a possibility that you may suffer a loss equal to or greater than your entire investment.

CFDs are complex instruments and involve a high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

The company is located in Singapore.

Julian Hosp M.D. has many experiences. He is a Trauma Surgeon In Residence and a Professional Kite Surfer. In 2015, Hosp co-founded TenX, a cryptocurrency-enabled Visa card, and mobile wallet.

Hosp, Chua and the TenX token sale were partners. It raised $80M for the project in June 2017. It was also one of the most successful ICOs at that time. However, the project was faced with enormous difficulties due to the 2018 cryptocurrency market crash.

Hosp ended their relationship with the project in 2019, causing many controversies. TenX was rebranded as Mimo in 2019, which appeared to be a liquidity pool platform and staking platform for a EUR stable token called Parallel. It will then shut down completely in 2021.

Since January 2019, U-Zyn Chua is the Chief Researcher of the DeFiChain Project. This project plays an important role in the Cake DeFi ecosystem.

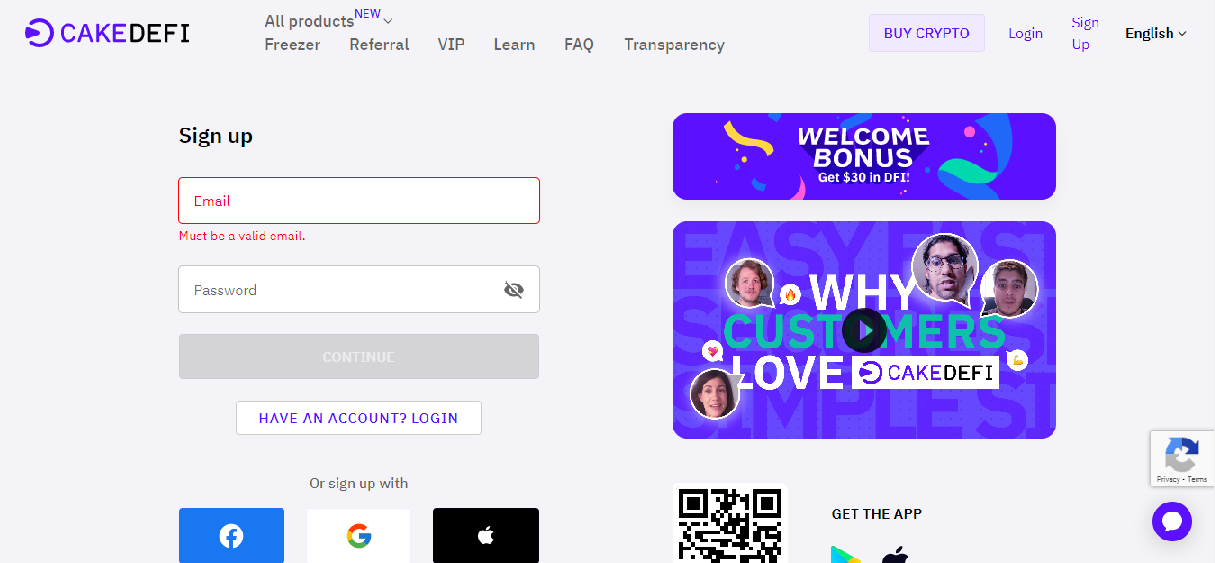

How to join Cake DeFi

These are the steps to join Cake DeFi.

- Register for a Cake Defi Account.

- Log in after verifying your email.

- Complete your KYC verification.

- Deposit $50 in any supported currency to the liquidity mining, lending, or staking freezers.

- The funds must be kept frozen for at most 28 days to be eligible.

- You will be rewarded with $30 in DFI coins

- You will also receive $10 for every referral.

Features

Cake DeFi Token

Cake DeFi designed many of its services around DeFiChain token (DFI).

DeFiChain, a non-Turing blockchain, aims to allow decentralized Bitcoin finance. DeFiChain is a PoS consensus system and anchors its latest Merkle root to BTC.

DFI was launched in August 2020. Its price reached its peak with a market capitalization of $2.34B by April 2022.

The project is managed by the Singapore-based DeFi Foundation. It is headed by Dr. Julian Hosp (chairman) and U-zyn Chua, the chief technology officer (CTO).

Liquidity Mining

Shared Liquidity Pools allow you to lend crypto and receive block rewards in Cake DeFi native DFI tokens. You can also earn swap fees in your chosen cryptocurrency. The community can only lend Bitcoin, Ether and USDT at the moment. It is possible to believe that something is too good to be true. I have seen claims of 80-90 percent APR and it sounds like a scam.

What’s the catch? The interest is paid in native DFI tokens, which Cake DeFi controls. Your DFI tokens are not guaranteed to be worth anything if you cash them in. You can only trade DFI tokens on a few exchanges, so you need an exit plan before you participate.

DFI tokens’ market value is dependent on Cake DeFi’s success, and Cake DeFi’s market value is also affected. This codependency suggests potentially unstable economics. Cake DeFi may experience runaway effects if they have to release large quantities of DFI in order to meet their guaranteed returns in case of a market crash.

Liquidity Pools

Cake DeFi provides shared liquidity mining pools that allow users to earn yield in pairs of popular coins and DFI tokens.

These liquidity pools offer a yield of up to 68% (subject change). All rewards are subject to 15% fees from Cake.

Each 12 hour, rewards are sent directly to your bank account on the Cake platform. It may take up to 24 hours to receive the first reward.

These rewards can be earned in either pair, so if your pool is BTC-DFI, you will receive the same amount BTC and DFI.

Users can withdraw their coins from liquidity mining pools at any moment.

Cake DeFi Lending

The lending service offers guaranteed returns and a bonus if the asset’s value increases over the term of the contract. It works this way:

Fixed-term ‘Batches’ for USDT, ETH and BTC are available that last for 28 days. You cannot withdraw funds from your account after the four-week period ends. This seems like a more achievable goal. The returns are listed at 7.5% to 8.8% APY. Each Batch has a maximum starting limit and is locked until it expires.

Each Friday, 4-week contracts begin at 4pm Singapore time for each asset (BTC/ETH/USDT). The upcoming BTC Batch saw a 30% increase in take-up the day before. With USDT pulling in only 16.3% of the potential million USDT, the ETH Batch has more than 90% subscribers.

When the price of the underlying cryptocurrency exceeds a certain threshold, a bonus is awarded. You would get an additional 2.5% APY on top of the 5% guaranteed interest payment. You will only get the guaranteed 5% portion of your rewards if the price remains the same or decreases. All your rewards and funds released at the end of a contract are automatically added to the next 4-week contract.

Staking

There are many ways to reach consensus, and therefore many different consensus processes. The two most popular and well-known ways to reach consensus on a distributed blockchain network are Proof-of Work (PoW), and Proof-of Stake (PoS). To validate transactions for cryptocurrency, Proof-of-Stake requires that money or tokens be deposited into “nodes”. Providers of this service receive stake benefits. The incentives are different from coin to currency in this sense.

Cake DeFi currently supports stake for these coins:

- Dash (DASH)

- DeFiChain

Two ways to participate in the staking are available:

- Deposit your chosen coin directly into your Cake DeFi Account.

- You can exchange your newly acquired BTC/ETH/DFI to any coin you choose. Go to the upper left and click on “Products”. Click on “Staking” next to your currency. You can then choose any coin to purchase your staking shares.

The Cake Freezer

For up to ten year, the most dedicated Cake users can choose to freeze or lock their DFI. They receive daily cash flow from their locked-up funds, as well as a 85% rebate on stake fees.

You can use the Cake Freezer by locking up your DFI for at least a month or a maximum of a decade. Your funds will automatically be allocated to the liquidity mining pool; your lock-up period determines how many bonuses you receive.

Let’s take, for example, 10,000 DFI being frozen for 1 month. Our Base APY would be 89% and our Freezer APR would be around 92%. We’d get 500 DFI in rewards for the first month.

Let’s also consider what would happen if we did a complete send to our DFI. Let’s say we are extremely bullish about the Cake platform and DFI token. We can see them both in 10 years.

Our Freezer APY would increase to around 108% over the 10-year period. This would mean that our 10,000 DFI would have become approximately 42,000 DFI by the end of the 10-year period.

Cake DeFi Security

Cake DeFi is an unusual service compared to other crypto yield services. Cake DeFi is like Celsius and BlockFi. By using the service you are putting your trust in them to protect your assets during the many yield-generation operations. Although it makes certain promises, there isn’t much to back them up.

However, it does offer different opportunities. Cake, unlike most crypto interest accounts, allows users to get substantially higher yields through liquidity mining or staking — activities normally reserved for DeFi-savvy people.

Borrowing on Cake DeFi

Security Measures

Borrowers have the option to use DFI as collateral, or mix it with other cryptocurrency such as Bitcoin (BTC), Ether(ETH), Tether ($USDT), USD Coin (USDC), as long as at least 50% of the collateral is DFI. The stablecoin DUSD is available in exchange for the borrower. It has been rated on CoinMarketCap, a highly-respected cryptocurrency price-tracking site.

Benefits of borrowing DUSD

Like any other stablecoins, DUSD can be used to purchase things and, even better, it can be used for investing. Participating in Cake DeFi’s Lending, Staking, and/or Liquidity Mining, directly or through swapping DUSD into other coins, is a viable way of investing the DUSD borrowed.

Conclusion

Cake DeFi offers something quite different from its crypto yield kin. Cake DeFi is a central company, similar to BlockFi and Celsius. By using the service you are trusting it with your funds during the various yield-generation activities. Although it does provide some guarantees, there is no substance behind them. This makes the service seem like marketing-speak.

It offers a wider range of opportunities. Cake offers much more than just yield on assets. It allows users to access liquidity mining and stake-activities that are normally reserved for DeFi-savvy people.

How is Cake able to offer 80% APY. Like most liquidity mining opportunities and staking opportunities in the market, the yield is paid out using DFI that Cake DeFi controls. The actual yield you receive is dependent on DFI’s price and your ability to sell it. Kucoin, Binance, and other exchanges are the most popular. There is limited support elsewhere.

These tokenomics are not good for DFI’s long term favor so locking DFI up in a “freezer” product for 10 years seems risky.

TenX’s controversy should not be ignored. However, it does not appear that the product was designed maliciously. The company is actually based in Singapore which follows different regulations than U.S.-based companies.

It doesn’t appear that the product is illegal, despite dubious claims about guaranteed returns and lack of response from the company. Surprisingly, the token has held its value well in recent years.

This guide is not intended to be a financial advisory or endorsement. Digital assets can be risky. Platforms that take custody of your assets could introduce another risk.