In 2001, Admiral Markets began operations. The Australian Securities and Investments Commission ( ASIC) has licensed the broker’s activities. Admiral Markets operates in over 40 countries and has a cash cycle of USD 40 billion. Admiral Markets is headquartered in the UK, with offices in Cyprus and Estonia.

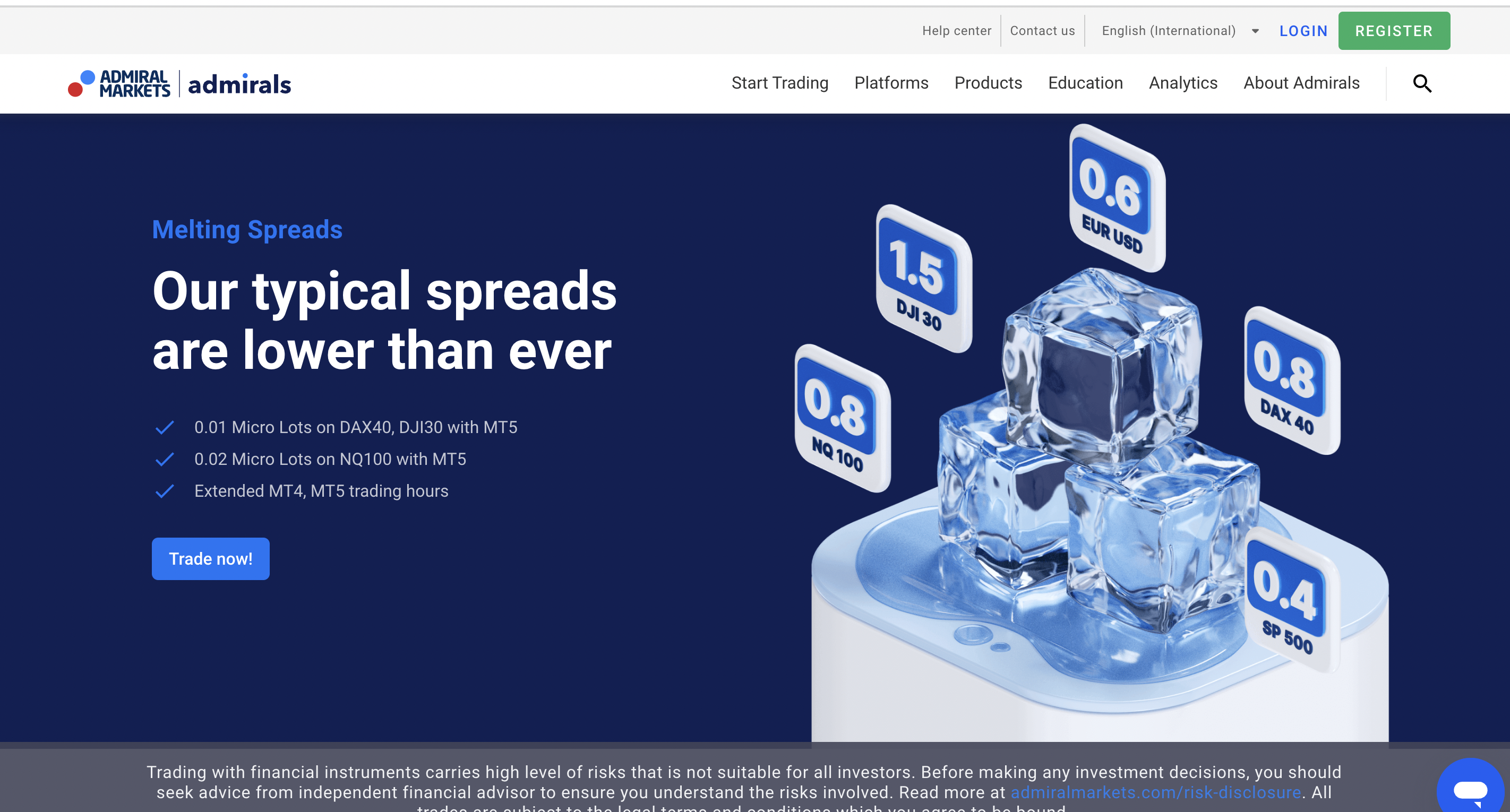

Admiral Market’s goal is to provide traders with access to quality software and functionality through transparent pricing and execution.

Trading is designed for high frequency and low latency. The system aggregates the flow from various banks and venues into one liquidity pool.

This allows for competitive spreads, deep liquidity, and no restrictions on trading strategies or styles. Also, rejection and slippage rates are low and trading speeds are high.

Admiral Markets Regulation

- Admiral Markets UK – FCA (UK), registration number 595450.

- Admiral Markets AS – Authorized by EFSA (Estonia), registration number. 4.1-1/46.

- Admiral Markets Cyprus Ltd. – CySEC (Cyprus), registration no. 201/13

- Admiral Markets Pty Ltd – Authorized by ASIC Australia registration ABN 63 151 613 0839 AFSL No. 410681

- Admiral Markets Canada Ltd. is authorized by IIROC Canada

The pros and cons of Admiral Markets

| Pros | Cons |

| Forex CFD Fees Low | CFDs limit product portfolio |

| Premium Analytics includes Dow Jones News, sentiment analysis by Acuity Trading and Trading Central signals.

|

Inactivity fee |

| Amazing content | |

| Offering 8,425 tradeable symbol: 3,827 CFDs, and 4,598 Exchange-Traded Securities (non-CFD). | |

| Fast and free withdrawals |

How to open an Admiral Markets Account

To trade Forex and CFDs on stocks, precious metals and energies on great terms with MetaTrader 4 and MetaTrader 5, or directly from your web browser using MetaTrader WebTrader, new applicants will need an Admiral Markets online account. The applicant simply needs to click the green “Register” button at the top-right corner of Admiral Markets’ website.

After this, the applicant will receive a registration form.

Top Recommended Platforms

78% of retail investor accounts lose money trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading forex or CFDs on margin involves a high degree of risk and may not be suitable for all investors. There is a possibility that you may suffer a loss equal to or greater than your entire investment.

CFDs are complex instruments and involve a high risk of losing money quickly because of the leverage effect. 68% of retail investor accounts lose money trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Step 1: Complete registration

To create an account, the applicant must complete a brief registration form.

Step 2: Confirmation

After completing the registration form, an Important Notification will be displayed. Before clicking on “Confirm”, the applicant should carefully read the notification.

Step 3: Activation

In order to complete the application, the applicant will be asked to verify their email address.

How to trade on Admiral Markets

Admiral Markets is regulated under the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commissions (CySEC). Every new client must go through a few compliance checks to ensure they understand the risks and are permitted to trade. These are the most common questions you will be asked to answer when opening an account. It is a good idea to have them handy.

- You should be aware that Proof of address documents for different entities may have different expiration dates.

- A scan of your passport, driving licence or national ID in colour

- An address proof document, such as a utility bill or bank statement for the last three months.

To confirm your trading experience, you will also have to answer some compliance questions. It is best to allow at least five minutes to complete the account opening process.

Admiral Markets may be available immediately, but you will not be able trade until you have passed compliance. This can vary depending on your circumstances and could take several days.

Types of Admiral Markets Account

Admirals offers two types of account: one that is supported by a trading platform and the other that is subject to a fee structure.

You have the option of choosing between MT4 or MT5 accounts for trading platforms. Both support the respective MetaTrader trading platforms.

You have several options when it comes to fee structure:

- Trade accounts: Lower or no commissions, but generally higher spreads

- Zero account: Up to $3 per lot commission, but generally lower spreads

- The Invest account is different from the other two because it can only be accessed on MT5 and allows you to trade stocks and ETFs.

An Islamic account can also be opened.

Trade Platforms

Let’s start with the Admiral Market software. They are located near all major liquidity providers. This in turn ensures the highest execution and lowest latency.

Admiral Markets uses reliable and convenient trading platforms MetaTrader4 & MetaTrader5 developed by MetaQuotes Software Corp, a world leader in trading software. Both platforms deliver powerful STP execution and are eligible to use EAs without restrictions. They also have a variety of useful tools.

Desktop Trading

MT4 is the most popular platform for Forex and CFDs trading, and it’s the one that traders around the world trust the most. A platform can be installed on a desktop or mobile device. You can also access it through the browser as WebTrader.

This plugin adds intuitive features to MT4 and makes it even more powerful. It includes trading widgets and mini terminal with management options. Also, the plugin has tick chart trader and indicator package.

Web Platform

The next option is MT5 which is an upgraded version of the powerful platform. It is also available on almost all devices and features Supreme Edition free of cost for any holder who has a live account with Admiral Markets. MT5 supports many versions, including mobile applications and web platforms.

Mobile platform

Trade from anywhere on your mobile device.

Customer Support

Admiral Markets traders will also have easy access to telephone support, live chat room, email and phone support. Its teams are professional and responsive so you can expect good support from the broker side.

Education

Admiral Markets also offers extensive support and educational materials. We found this through Admiral Markets Review. They offer a variety of seminars, data research, and support for their clients every day, so even a complete beginner will feel at ease with Admiral Markets.

Dow Jones provides market analysis and news free of charge. The platforms also have trading tools and extensions that allow you to make better trading decisions based on the most recent information.

Admiral Markets Copy Trading

Admiral Markets Copy Trading allows traders to not only see the best traders, but also copy their trades. Traders can also share their knowledge with other traders. To get started, log in to the Traders Room dashboard.

Admiral Markets: Can you trust them?

Admiral Markets has a good reputation. Admiral Markets is used daily by more than 10,000 traders and Admiral Markets customers. Admiral Markets can be considered safe because they are regulated and monitored by the Financial Conduct Authority, Cyprus Securities and Exchange Commission (CySEC) and for their conduct. All payments made to Admiral Markets accounts from traders are kept in a separate bank account. Admiral Markets only uses tier-1 banks to provide additional security. Tier 1 is the official indicator of a bank’s financial strength and health. Admiral Markets offers Forex trading and CFDs trading. Admiral Markets requires a $100 minimum deposit.

Affiliate Program at Admiral Markets

Clients can partner with market leaders and turn their traffic into revenue by using the Admirals Affiliate program. Admirals is the best program for website publishers, digital marketers and media buyers. It also suits webmasters, affiliate network members, social media influencers, webmasters, webmasters and mobile marketers. Referring their audience to Admirals can result in generous commissions up to $600 per convert.

Admiral Markets Review

Admiral Markets is a trusted broker that has been regulated and provides easy-to-use trading conditions, education materials, and research tools. Admiral Markets offers the opportunity to trade with top-tier liquidity providers due to its high execution speed and low start deposit. MT4 and MT5 are industry-proven platforms that allow for optimizations and technical solutions.

Trading financial instruments can be risky and not for everyone. To fully understand the risks associated with investment decisions, it is a good idea to seek out independent financial advice before making any investment decision. This article does not constitute financial advice.